All Categories

Featured

Table of Contents

At the end of the day you are buying an insurance policy product. We enjoy the security that insurance coverage supplies, which can be gotten much less expensively from a low-priced term life insurance policy. Overdue financings from the policy may likewise reduce your survivor benefit, decreasing an additional level of protection in the plan.

The concept just works when you not only pay the significant premiums, yet utilize added money to buy paid-up additions. The opportunity price of all of those dollars is tremendous exceptionally so when you might instead be buying a Roth IRA, HSA, or 401(k). Even when contrasted to a taxed financial investment account or perhaps an interest-bearing account, boundless financial may not use comparable returns (compared to spending) and comparable liquidity, accessibility, and low/no fee framework (contrasted to a high-yield savings account).

When it comes to economic preparation, entire life insurance often stands out as a preferred alternative. While the concept may seem attractive, it's crucial to dig deeper to comprehend what this actually suggests and why viewing whole life insurance in this method can be misleading.

The idea of "being your own bank" is appealing due to the fact that it suggests a high level of control over your finances. This control can be illusory. Insurance coverage business have the supreme say in how your policy is handled, consisting of the regards to the financings and the rates of return on your cash worth.

If you're taking into consideration entire life insurance coverage, it's necessary to see it in a broader context. Whole life insurance policy can be a useful device for estate preparation, offering an ensured death benefit to your beneficiaries and possibly offering tax obligation advantages. It can likewise be a forced savings car for those that have a hard time to conserve money consistently.

It's a kind of insurance coverage with a financial savings part. While it can offer stable, low-risk growth of cash value, the returns are usually reduced than what you could attain with various other financial investment automobiles (ray poteet infinite banking). Prior to delving into entire life insurance policy with the idea of unlimited financial in mind, make the effort to consider your monetary goals, risk tolerance, and the complete series of economic products available to you

Infinite Banking Concept Uk

Infinite financial is not a financial cure all. While it can operate in certain situations, it's not without risks, and it needs a considerable commitment and understanding to take care of effectively. By identifying the prospective pitfalls and understanding real nature of whole life insurance, you'll be much better geared up to make an informed decision that supports your economic wellness.

This publication will show you just how to establish a financial policy and exactly how to make use of the financial plan to invest in real estate.

Limitless banking is not a product and services used by a details organization. Infinite banking is a technique in which you get a life insurance coverage policy that builds up interest-earning cash money value and secure financings versus it, "borrowing from yourself" as a resource of resources. Eventually pay back the financing and start the cycle all over once again.

Pay plan costs, a section of which develops cash value. Take a car loan out against the policy's money worth, tax-free. If you utilize this concept as planned, you're taking cash out of your life insurance policy to purchase every little thing you 'd need for the rest of your life.

The are whole life insurance coverage and universal life insurance coverage. The cash worth is not included to the fatality benefit.

After ten years, the cash money value has actually grown to about $150,000. He gets a tax-free lending of $50,000 to start a company with his bro. The policy financing rate of interest is 6%. He pays back the loan over the following 5 years. Going this route, the passion he pays returns into his plan's cash money worth instead of a banks.

Infinite Banking Concept Pros And Cons

Nash was a money expert and follower of the Austrian college of economics, which supports that the value of items aren't clearly the outcome of standard financial frameworks like supply and demand. Rather, people value cash and products differently based on their economic condition and requirements.

One of the pitfalls of traditional banking, according to Nash, was high-interest rates on fundings. Too numerous individuals, himself consisted of, got involved in financial difficulty due to reliance on banking establishments. Long as banks set the interest rates and loan terms, people didn't have control over their very own wealth. Becoming your very own banker, Nash established, would certainly put you in control over your economic future.

Infinite Banking needs you to have your financial future. For ambitious individuals, it can be the best financial tool ever before. Here are the advantages of Infinite Financial: Perhaps the single most beneficial element of Infinite Financial is that it enhances your cash money flow.

Dividend-paying entire life insurance coverage is very reduced danger and provides you, the policyholder, a wonderful bargain of control. The control that Infinite Financial uses can best be organized right into two classifications: tax obligation benefits and asset protections.

When you use whole life insurance coverage for Infinite Banking, you get in into a private agreement in between you and your insurance company. These defenses may vary from state to state, they can include protection from possession searches and seizures, protection from reasonings and defense from lenders.

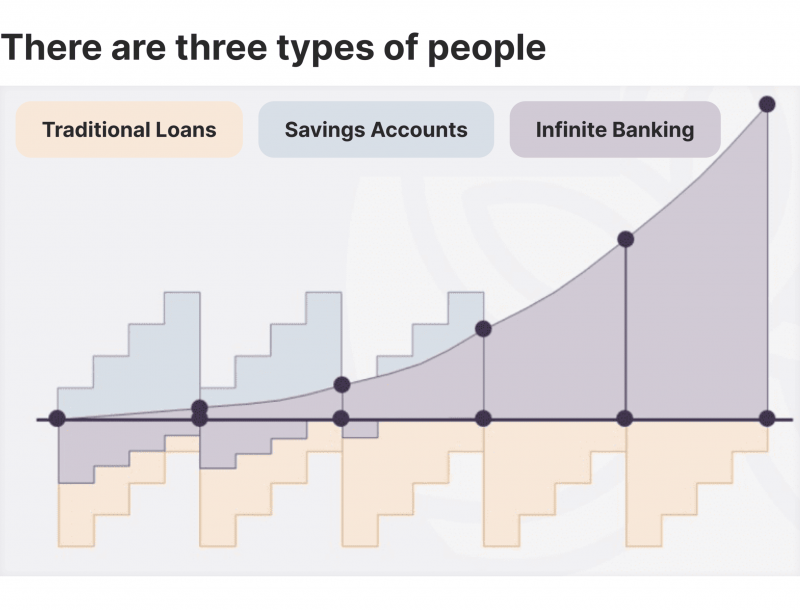

Whole life insurance policies are non-correlated assets. This is why they function so well as the economic structure of Infinite Banking. Regardless of what takes place in the market (supply, property, or otherwise), your insurance coverage policy preserves its worth. Way too many people are missing out on this vital volatility barrier that helps safeguard and expand wealth, rather breaking their cash into two buckets: financial institution accounts and investments.

How Infinite Banking Works

Whole life insurance coverage is that 3rd container. Not only is the rate of return on your whole life insurance coverage plan assured, your fatality advantage and premiums are also guaranteed.

Right here are its main benefits: Liquidity and accessibility: Plan financings give prompt accessibility to funds without the limitations of conventional bank financings. Tax obligation performance: The money worth grows tax-deferred, and plan finances are tax-free, making it a tax-efficient tool for building wide range.

Asset security: In lots of states, the cash money value of life insurance policy is safeguarded from financial institutions, including an extra layer of financial security. While Infinite Banking has its merits, it isn't a one-size-fits-all service, and it features substantial downsides. Below's why it might not be the best technique: Infinite Financial usually calls for detailed policy structuring, which can confuse policyholders.

Envision never ever needing to stress over financial institution financings or high passion prices once again. What if you could borrow money on your terms and develop riches simultaneously? That's the power of unlimited financial life insurance policy. By leveraging the money value of whole life insurance policy IUL policies, you can grow your wide range and obtain money without relying upon typical financial institutions.

There's no set financing term, and you have the flexibility to pick the payment timetable, which can be as leisurely as settling the funding at the time of death. This versatility includes the maintenance of the financings, where you can decide for interest-only repayments, maintaining the finance equilibrium flat and convenient.

Holding cash in an IUL dealt with account being credited passion can typically be better than holding the money on deposit at a bank.: You have actually always fantasized of opening your very own bakeshop. You can obtain from your IUL policy to cover the first expenses of renting out a room, purchasing equipment, and working with team.

Be My Own Banker

Individual lendings can be acquired from typical financial institutions and lending institution. Here are some bottom lines to consider. Bank card can provide an adaptable method to obtain money for very short-term periods. However, obtaining cash on a charge card is generally really expensive with interest rate of rate of interest (APR) often getting to 20% to 30% or more a year.

The tax therapy of policy lendings can vary considerably depending upon your nation of house and the specific terms of your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy loans are usually tax-free, offering a substantial advantage. Nonetheless, in various other jurisdictions, there may be tax effects to think about, such as potential tax obligations on the funding.

Term life insurance policy only offers a survivor benefit, without any type of cash worth accumulation. This implies there's no cash money value to obtain versus. This article is authored by Carlton Crabbe, Chief Executive Police Officer of Resources for Life, an expert in supplying indexed global life insurance policy accounts. The details given in this article is for educational and informational purposes just and need to not be construed as financial or investment guidance.

For car loan policemans, the extensive policies imposed by the CFPB can be seen as difficult and limiting. Loan policemans commonly argue that the CFPB's guidelines produce unneeded red tape, leading to even more paperwork and slower financing handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) needs, while aimed at protecting consumers, can cause hold-ups in shutting offers and raised functional costs.

Latest Posts

Unlocking Wealth: Can You Use Life Insurance As A Bank?

Infinite Insurance And Financial Services

Becoming Your Own Banker Nash